In the October edition of the expected returns report of Alpha Research, it turned out that expected returns of the vast majority of participants in the survey have risen. At first sight this seems to be at odds with the deteriorating macro climate and the less accommodative stance of global central banks. However, higher rates and more attractive valuations generally underpin the higher return forecasts. Also, as a result of the generally weaker and more risky macro climate, higher risk premia are warranted.

Forecasts of three market participants

In this article we highlight the forecasts of three market participants that deviate relatively strongly from the consensus views.

Robeco – 5 year expected returns

According to Robeco financial markets are highly confused. Since the start of the year four different economic scenarios have been observed from time-to-time, being risk-on (rising bond yields, decreasing credit spreads); risk-off (declining bond yields, rising spreads); Quantitative Tightening (rising bonds yields and spreads) and Quantitative Easing (declining bond yields and spreads). In the base case scenario, Robeco expects a US recession in 2023, that will ease inflationary pressures. This will provide room for the Fed to cut rates and the economy to recover. However, inflation is expected to remain in the twilight zone (2,6% on average during 2023-2027) and monetary policy will not be as accommodative anymore as in the Great Moderation area. US growth is downgraded from 2,3% to a below trend 1,75% on average in the next five years. Worsening demographics will decelerate China’s real growth to below 5%.

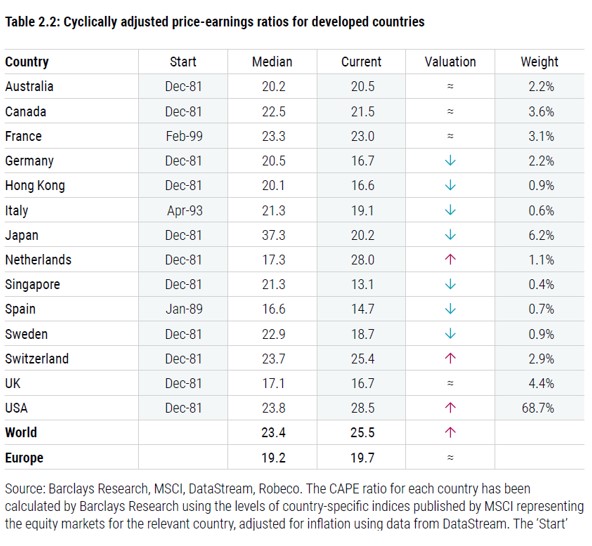

In this area of confusion, Robeco has reduced expected returns on equities by 0,25%, leading to 4% annual nominal returns on average for developed markets. This decrease of expected returns are in contrast to the increase in expected returns by most participants in the Alpha Research expected returns survey. According to Robeco, uncertainty regarding the macro climate and the expected volatility of consumption growth warrant a higher equity risk premium than is currently reflected by the market. See the table below for equity valuations on the basis of the long-term, cyclically adjusted PE ratios (CAPE) for developed markets. Although valuations have been coming down markedly this year, the CAPE for global equities is still above the long term median level.

The surge in interest rates since September 2021 has resulted in higher expected returns for many fixed income classes. Compared to last year, taking equity risk is less rewarded than taking fixed income risk.

The surge in interest rates since September 2021 has resulted in higher expected returns for many fixed income classes. Compared to last year, taking equity risk is less rewarded than taking fixed income risk.

DWS – The Long view Q2

In their Long View, DWS has materially increased the return forecasts for the next decade. Global financial markets were highly volatile over the second quarter of 2022. Persistent inflationary pressures forced central banks towards monetary tightening. As a result the risk of a global recession has been pulled forward. Higher interest rates and weaker economic data weighed on risk markets. The resulting weakness in financial assets has improved the long-term investment prospects in nominal terms. Compared to the first quarter of this year, the expected annual return for global equities has been raised by 1% to 6,6%.

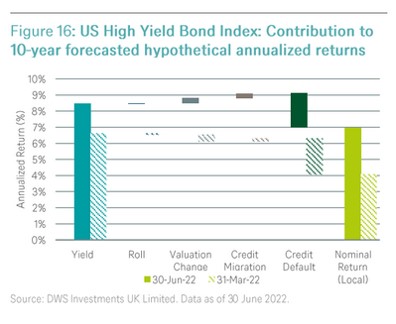

Within fixed income expected returns are raised on the back of higher rates and wider credit spreads. The return forecast for US high yield has been raised by 2,9% compared to the first quarter, to an expected annual return of 7% for the next decade. This was DWS’ biggest increase in the expected returns for all asset classes.

DWS does however point at emerging paradigm shifts. These structural trends are not inevitable and are not reflected yet in their base case return forecasts for assets classes, but DWS believes it is prudent to further explore these trends.

In an alternative scenario, the destructive consequences of climate change manifest themselves starkly over the coming decade. Resulting problems like water scarcity and famines lead to further geopolitical instability. Deglobalisation will lead to higher inflation and will limit the ability of central banks to support economic and market stress.

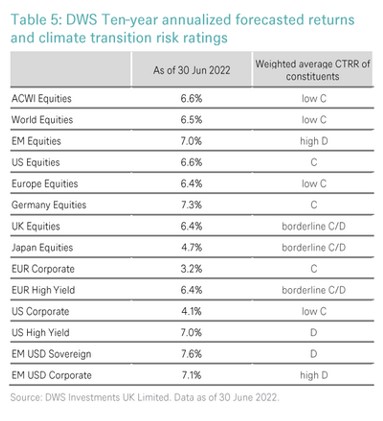

Most of the current megatrends have a decreasing impact on real GDP growth, while inflationary pressures will increase going forward. Overall this will lead to more subdued outcomes for financial markets. On the other hand, asset classes that will be able to effectively manage the climate transition risk can present investors with some attractive investment opportunities. Emerging markets equities, US high yield and emerging markets US dollar sovereigns are among the categories with the poorest climate transition risk ratings (CTRR) and highest return forecasts (see table below).

Vanguard – Market Perspectives

Vanguard – Market Perspectives

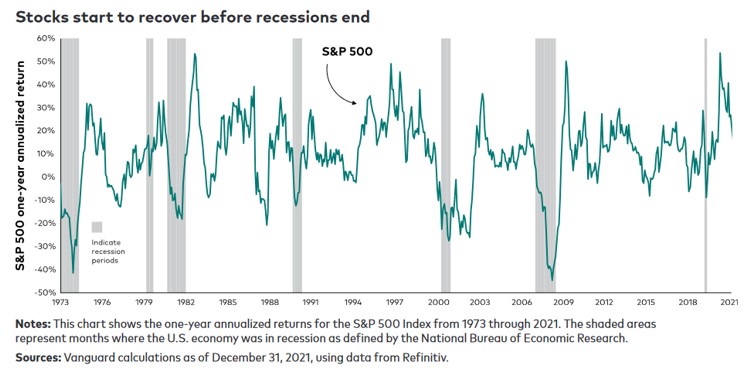

In the most recent Market Perspectives, Vanguard downgrades growth forecasts for the United States for 2022 down from 1,5% last month to 0,25-0,75% in October. Vanguard places the likelihood for a US recession at 25% for the coming 12 months and 65% in the next 24 months. Vanguard foresees stronger growth for the euro area versus the Unites States, but indicate that risks are skewed to the downside. The shape of the yield curve is watched for signals of recession. Vanguard indicates it is virtually impossible to time the market, because when a recession occurs, it is not known how long it will last. However, equity prices often begin to fall before the start of an actual recession and typically start to recover before the end of the recession. This is shown in the graph below.

Vanguard sees most risk to the outlook for emerging markets and has a below consensus view. The GDP growth forecast stands at 3% versus around 5,5% at the start of the year. Primary headwinds for emerging markets are widespread central bank tightening and the simultaneous slowing of growth in the United States, the euro-area and China. Also higher commodity prices are generally negative for emerging markets.

Nieuwsbrief

Asset Allocation Awards

Sinds 2016 reikt Alpha Research elk jaar de Asset Allocation Awards uit aan de beste beleggingsspecialisten.

De beleggingscategorieën zijn: Asset Allocation, Fixed Income, Equities Regional, Equities Sector en Overall.